Once riding the wave of one of the nation’s hottest real estate booms, Central Florida home prices are now cooling off sharply. Values are dropping, listings are piling up, and buyers are gaining ground. But here’s the thing: this shift is less of a setback and more of an opportunity. After years of record-breaking growth, the market is finally balancing out. Rising inventory and longer days on market are giving buyers more leverage than ever before.

While price declines may sound alarming, they open the door for first-time homeowners, relocating families, and investors ready to take advantage of Central Florida’s long-term strengths—from Disney’s tourism-driven economy to Orlando’s growing tech and medical sectors.

Market Snapshot: Central Florida in 2025

Statewide dips: Florida’s June 2025 median single-family home price dropped 3.5% to $412,000, while condo-townhouses slid 7.7% (Florida Realtors).

Redfin data: July 2025 showed a 1.4% year-over-year decline in Orlando home prices ($404,100 median), with median days on market hitting 75 and active listings rising 9.2%.

Business Insider report: Florida’s slowdown is a cautionary tale for other booming markets, driven by affordability crunches and oversupply.

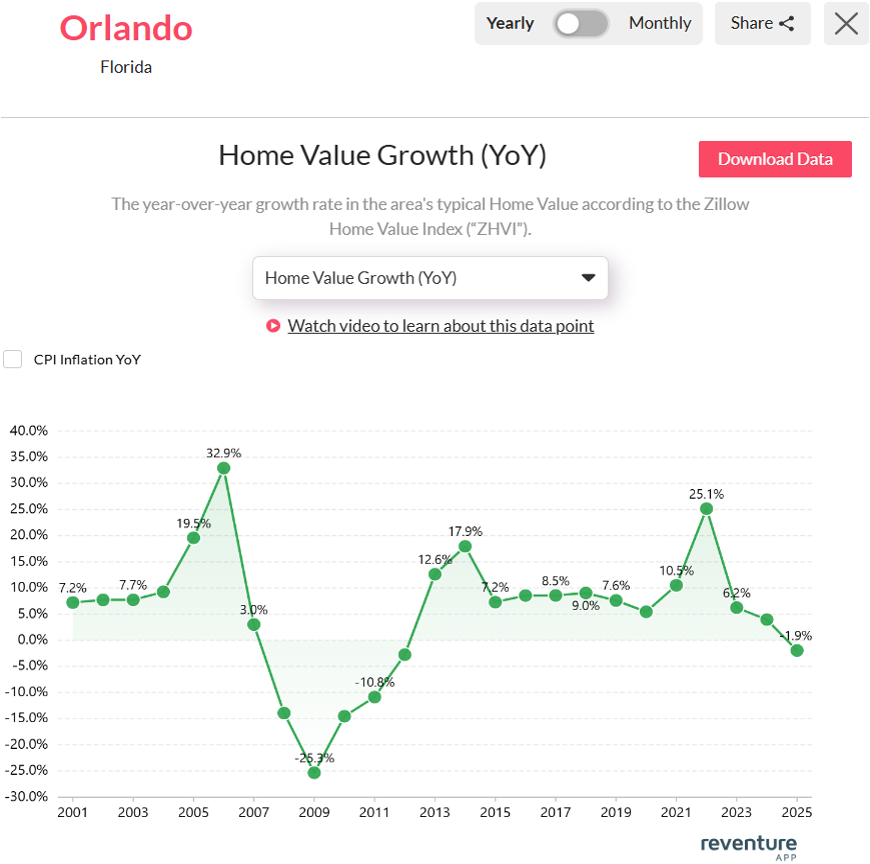

Here’s a visual snapshot of the situation: Orlando’s year-over-year home value growth has flipped to –1.9% in 2025, a significant reversal from the peaks of 25% in 2022 and 6.2% in 2023, signaling a sharp market correction. Selling times are stretching, with Days on Market reaching up to 62 days, and nearly 30% of listings now carry price reductions.

Why Central Florida Home Prices Are Dropping

Rising Inventory

Florida inventory is at its highest level since 2011, with Orlando listings up 35% year-over-year. More supply means downward pressure on prices (CF Public).

Insurance Costs

Homeowners’ insurance in Florida has soared, rising over 50% since 2019. These added costs make affordability even harder for buyers.

New Construction Competition

Large builders with in-house financing are offering below-market interest rates, making new construction more appealing than resale homes

What It Means for Buyers

- Greater leverage in negotiations, with nearly 30% of listings showing price cuts.

- More options across Orlando, Groveland, and inland markets like Ocala.

- Entry points at lower prices in one of the country’s fastest-growing regions.

What It Means for Sellers

- Expect longer days on market (averaging 62+ days).

- Competitive pricing and professional staging are key to standing out.

- Marketing strategies must highlight lifestyle, not just square footage.

What It Means for Investors

- Inland areas like Ocala and Groveland present affordability and stability.

- Multi-family and rental properties may offer stronger returns than resale flips.

- Buying during a dip positions investors for long-term appreciation when demand rebounds.

Final Thoughts

The big picture? Central Florida home prices are falling in 2025, but the market isn’t collapsing—it’s correcting. For buyers, this means opportunity. For sellers, it’s about strategy. And for investors, it’s a chance to secure properties in a region with strong fundamentals and future growth.

✨ Thinking about your next move? Whether buying, selling, or investing, Diamond Real Estate Group is here to guide you through Orlando’s evolving market with expert insight and proven results.

📲 Call or text 407-797-2931

📧 Email tiphany@dregorlando.com

🌐 Visit www.dregorlando.com to start your home-selling journey.

Meet Tiphany

Orlando Real Estate Pro

Buying a home is one of the most important purchases one can make, but it doesn’t need to be complicated. I’m Tiphany Weeks, the founder and broker of record for Diamond Real Estate Group. While traveling the world as a baseball wife we moved around a lot; and it wasn’t always easy. I realized the search to find a realtor that knows exactly what you need can be a very daunting task, so I decided it was time to create a new solution for helping people find their way home.

- Top Orlando Schools and the Neighborhoods Buyers Want Most

How Education Shapes Home Values and Buyer Decisions Across Central Florida Families relocating to the area, move-up buyers, and long-term investors alike are paying close attention to school zones, and for good reason. Top Orlando schools are one of the strongest drivers of demand, pricing resilience, and long-term value across the region. At Diamond Real… Read more: Top Orlando Schools and the Neighborhoods Buyers Want Most

How Education Shapes Home Values and Buyer Decisions Across Central Florida Families relocating to the area, move-up buyers, and long-term investors alike are paying close attention to school zones, and for good reason. Top Orlando schools are one of the strongest drivers of demand, pricing resilience, and long-term value across the region. At Diamond Real… Read more: Top Orlando Schools and the Neighborhoods Buyers Want Most - When Success Feels Like Failure: A Reflection on 2025

A Personal Note from Diamond Real Estate Group This is hard to say, and even harder to type, but here it is: I failed.Let’s start from the beginning. 2025: A Year of Change, Loss, and Growth 2025 was a rollercoaster, full of surprises, challenges, wins, losses, pivots, heartbreak, and joy. I began the year in… Read more: When Success Feels Like Failure: A Reflection on 2025

A Personal Note from Diamond Real Estate Group This is hard to say, and even harder to type, but here it is: I failed.Let’s start from the beginning. 2025: A Year of Change, Loss, and Growth 2025 was a rollercoaster, full of surprises, challenges, wins, losses, pivots, heartbreak, and joy. I began the year in… Read more: When Success Feels Like Failure: A Reflection on 2025 - How to Buy a Home With a Realtor in Orlando (And Why It Matters)

Buying a home is a major financial decision, and in Central Florida’s fast-paced market, the right guidance is essential. If you plan to buy a home with a realtor in Orlando, knowing how buyer representation works and what to expect can make a big difference. At Diamond Real Estate Group, we believe that informed buyers… Read more: How to Buy a Home With a Realtor in Orlando (And Why It Matters)

Buying a home is a major financial decision, and in Central Florida’s fast-paced market, the right guidance is essential. If you plan to buy a home with a realtor in Orlando, knowing how buyer representation works and what to expect can make a big difference. At Diamond Real Estate Group, we believe that informed buyers… Read more: How to Buy a Home With a Realtor in Orlando (And Why It Matters)

Leave your thoughts: